Share Trading Know all about Online Share Market Trading

Contents:

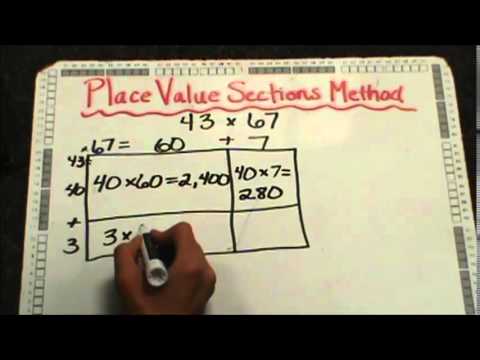

When you think of investing in the shares of a company, you must conduct thorough due diligence on the background and credibility of the company. You must look at various parameters such as income growth, net income, debt to equity ratio, stock splits, price/earnings ratio, market capitalization, issuance of dividends, etc. Moreover, you need to understand the different technical terms while conducting market research. Share market trading time between 9.55 am and 3.30 pm, the Indian standard time (+ 5.5 GMT hours), from Monday to Friday. The timing remains the same for all the major stock exchanges in India, like the Bombay stock exchange and the National Stock exchange . Technical trading requires a thorough market analysis wherein the traders understand stock price changes and make trading decisions accordingly.

Investopedia’s 2023 Best Online Brokers Awards – Investopedia

Investopedia’s 2023 Best Online Brokers Awards.

Posted: Mon, 27 Feb 2023 08:00:00 GMT [source]

One of the most lucrative savings and investment options is the share market which comes with a higher risk factor but also attributes a much higher return on investment than other options. Update your mobile numbers/email IDs with your stock brokers. Receive information of your transactions directly from exchange on your mobile/email at the end of the day. Investments in securities market are subject to market risks, read all the related documents carefully before investing.

Frequently Asked Questions for the Online Trading

Every instrument has its specific online trading exchange. The National Stock Exchange – NSE and The Bombay Stock Exchange Ltd- BSE trades Derivatives such as Interest Rate Derivatives, Equity Derivatives, Global Indices Derivatives and Currency Derivatives. Additionally, it also trades Capital Market products such as Mutual Funds, IPOs, Traded Funds, Equities, Stock Lending and Borrowing, and Debentures. MCX Stock Exchange Limited -MCX-SX deals with Capital Markets. Multi Commodity Exchange of India Ltd -MCX and National Commodity & Derivatives Exchange Limited -NCDEX offer Commodities Trading like gold, metals, agro-commodities, bullion, etc. On the other hand, if you want someone to manage your money for you, then you may consider hiring a financial advisor for a fee.

Best Investment Apps UK For April 2023 – Forbes Advisor UK – Forbes

Best Investment Apps UK For April 2023 – Forbes Advisor UK.

Posted: Mon, 03 Apr 2023 12:14:22 GMT [source]

Financial advisors can buy and sell stocks, mutual funds, ETFs, and other financial assets based on your financial goals and risk tolerance. Our sister site, investor.com, screens financial firms in the U.S. and identifies those that are fiduciaries, indicating the firm is required to put your interests above its own and disclose any conflicts of interest. Vanguard – Vanguard is aimed squarely at buy-and-hold investors, and its platform reflects that focus. Vanguard is known for its low-cost funds, and the investment platform is really built for those looking to invest in mutual funds and ETFs, though stock trades are supported on the website. HDFC securities provides a seamless online real-time platform to trade and track your stocks, with a smart all inclusive portfolio. To trade you can use any of online trading platform, Mobile App or simply Call N Trade.

Can I trade in online share market trading when the markets are closed?

Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. For the StockBrokers.com 13th Annual Review published in January 2023, a total of 3,332 data points were collected over three months and used to score 17 top brokers. This makes StockBrokers.com home to the largest independent database on the web covering the online broker industry. Here are the Overall rankings for the 17 online brokers whose offerings we analyze and test, sorted by Overall ranking.

In the case of day trading or intraday trading, traders have to close the positions within the trading hours. If not closed, open positions get squared off at market closing price. But whether you want to be a trader or investor, you should be aware of the share trading time in the Indian stock market.

Different interface harams a different user experience. While the desktop trading platform is the fastest, you cannot carry them everywhere. Options for customizing the trading platform are helpful in creating a personalized workstation that helps you trade comfortably without stress. The customizing function also helps you set up trading strategies. You have access to advanced charts and Chart IQ and other Zerodha apps & services like Coin, Varsity and Sentinel. UpStox charges Rs. 0 on delivery and Rs. 20 per transaction on intraday and F&O trades.

Fryers One is a desktop trading platform with inbuilt stock screeners, that help you gauge trends, support and resistance levels and intraday movements. The platform has the option to set order quantity either by absolute number, trade value or current market price which helps you trade based on your preferences. Zerodha charges a flat Rs. 20 brokerage for intraday and F&O trading. Additionally, you access predefined watchlist, create a customized watchlist, receive real-time market feeds and set an unlimited number of price alerts.

Best Trading Platforms and Stockbrokers 2023

Webull will https://1investing.in/eal to the mobile-first generation of casual investors with its slick interface for desktop and mobile apps, but the brokerage also delivers an impressive array of tools for active traders. However, its relatively weak educational content may leave true beginners in the lurch, and it lacks access to a few common asset classes. The investing information provided on this page is for educational purposes only.

But if the stock price increases, you still have to buy the stock to close their position, and you will lose money. However, once you master those basic concepts, you can add advanced strategies to your trader’s toolbelt. If minimizing your tax bill is a primary concern, consider a retirement account like a Roth IRA or 401 plan instead of a standard brokerage account. The loss will be accounted for once you sell the stock again.

How to buy stocks for step-by-step instructions on placing that first trade. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money.

Shopping Voucher Worth Rs. 500* on every successful* account opened

Initial Public Offering involves investing in the primary stock market through IPOs. When you submit your IPO, applications are scrutinised, after which the shares are allocated based on demand and availability. You need a Demat account containing electronic copies of your shares. Besides, it is also essential to have a trading account that helps buy and sell stocks online. If you buy individual stocks through a brokerage that doesn’t charge commission fees, you might not have any expenses.

Stock Market for Teens – Investopedia

Stock Market for Teens.

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

There are also new platforms that specialize in small trades and easy-to-use apps, such as Robinhood, WeBull, and SoFi. Which style and size of brokerage is best will depend on you. Big firms like Fidelity, Vanguard, and Charles Schwab have both online and app-based trading tools. They have been around for years, have low fees, and are well known. Zerodha Kite provides a range of widget features to personalize the platform and intuitive user interface that is best among the other trading platforms. You need to have the best software for your online trading needs.

Best Trading Platforms 2023

In contrast, a stock market deals with other financial instruments like bonds, mutual funds, shares, and derivatives. Yes, you can have more than one demat or trading account with the same broker or any other broker. Some investors hold various accounts to segregate their holdings according to their various financial goals. Some may have a retirement account, commodities account, margin account, etc., based on their trading strategies. If you are an active Future and Options trader, having multiple accounts works in your favour as you can have a long position in one trading account and short position in another. If either of your positions moves against you, you have the other one to fall back on.

He holds two of the most widely recognized certifications in the investment management industry, the Chartered Financial Analyst and the Chartered Market Technician designations. Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets. As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy. Brokers also were offered the opportunity to provide executive time for an annual update meeting.

Beginners will find the mobile app and website easy to navigate. Sophisticated investors can keep clicking toward a wealth of detail. Merrill’s Stock and Fund Stories, along with Portfolio Insights, are thoughtfully designed to ensure investors make informed investing decisions. If you prefer your banking and investing under one roof, check out Bank of America’s killer Preferred Rewards program, which also counts balances at Merrill Edge. India is an emerging market and a tiny percentage of income earned in India is invested in the share market.

Access to data, insights and analyst research via these trading platforms, coupled with innovations such as demo accounts and social trading, supported the boom. A stock market is a place where thousands of traders use different strategies. Some of the types of trading are swing trading, intraday trading, position trading and scalping trading. Investments in securities market are subject to market risk, read all the related documents carefully before investing. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time.

Traders can quickly assess market movements using Fryers One “Heat map”, Market dynamics and Index meter tools. One can trade using more than 60 indicators and studies to perform required in-depth technical analysis. The platform needs a minimum Pentium 4 processor with 1GB RAM. The desktop can be customized to track and create multi-assets watch lists for equity, derivatives, currency and commodities.

The account opening is paperless and you can use the app as soon as the account is operative. The idea of trading is to make profits by selling the same shares at a price higher than the buying price later when the price moves. Log in to your account and visit the fund transfer section. The bank you added during sign-up will be linked to your trading account.

- EToro – eToro’s primary strengths can be found in its crypto and its investing community.

- When you buy or sell a traded asset, such as a stock or ETF, there are different types of trade orders you can place.

- Further, you have the facility to open multiple charts and link them all either by period, scrip or exchange.

How to choose the best broker for you can help you sort through the features brokerage firms offer and rank your priorities. We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The final output produces star ratings from poor to excellent . When you open a new, eligible Fidelity account with $50 or more. Kevin Voigt is a former staff writer for NerdWallet covering investing. He previously was a reporter with The Wall Street Journal and business producer for CNN.com in Hong Kong, where he was based for nearly two decades.

He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. SoFi Invest – SoFi Invest offers a wide range of services, is relatively easy to use, and gets high marks for its investor community features. Its sparse research and lagging education and trading tools leave it a step behind industry leaders. Interactive Brokers – Though IBKR, as it’s known, is primarily thought of as a broker for professionals, two of its mobile apps, GlobalTrader and Impact, are remarkably user-friendly.

India’s GDP is growing at a rate of 7-8% each year, and the financial market is relatively stable. The timing is right for foreign investors to trust the Indian share market, so you must lose out on the chance of earning good returns by investing in the share market. Share market online trading companies with an extensive network as it does not require a lot of analytical skills but more network speed. A long-term trader invests in growing shares and researches the companies he has invested in, evaluating their balance sheets, sectors, latest news, etc. The rules for making money online are the same as they are for any method of stock trading. You need to know how to evaluate stock trends, assess taxes and expenses, use smart types of orders, and take appropriate risks.